Retirement with an Immediate Annuity

Definitions

Where does a Single Premium Immediate Annuity (“SPIA”) fit in a retiree’s portfolio? I have found that these products are widely misunderstood and underutilized, as they can fit well in a retiree’s portfolio when applied suitably.

First off, what is a Single Premium Immediate Annuity? Let’s break it down.

Single Premium — This means that you only pay once, upfront, with the total amount the annuity costs.

Immediate — This means that it starts paying out, or annuitizes, right away, usually within 30 days to 12 months.

Annuity — An annuity is a type of insurance contract that policyholders pay into (accumulation phase), and then are paid out of (annuitization phase).

It works very similarly to a pension, where you may receive less or more than you put into the annuity.

Payments continue for your lifetime, or a set period like 10–20 years.

Just like insurance, almost everything is customizable with an annuity.

Putting it all together…

A Single Premium Immediate Annuity is a product where you pay once, up front. It starts right away. The annuity pays you income every month, at a set rate, for the rest of your life, no matter how long or short it is.

Credit: Retirement Cafe

Riders

When I said that annuities are customizable, this is what I meant. Annuities have optional add-ons to the policy called riders. With SPIAs, there are usually only as few major riders that one might want to include. These riders include certain periods and refunds.

Certainty periods are a set of dates, typically 10 or 20 years, where the beneficiary will receive the remainder of the income from the annuity if the annuitant passes away before the period is over. It typically begins at the same time as the annuitization. Certainty periods are meant to ensure that the beneficiary continues to receive income for a period. This could be helpful if the annuitant is the primary source of income for the family, and their income stopping when they pass away would leave the family with expenses they can’t cover on their own.

Cash refund riders ensure that the beneficiary of the annuity received a lump sum of the difference between the price paid for the annuity and the payments received by the annuitant. Refunds are a way for folks to ensure that their entire purchase price is dolled out, meaning that with a refund rider, there isn’t a possibility of losing out on money paid into the annuity. All of it will be paid, either to the annuitant (and if they continue living past that point, payments continue but the refund won’t) or the beneficiary.

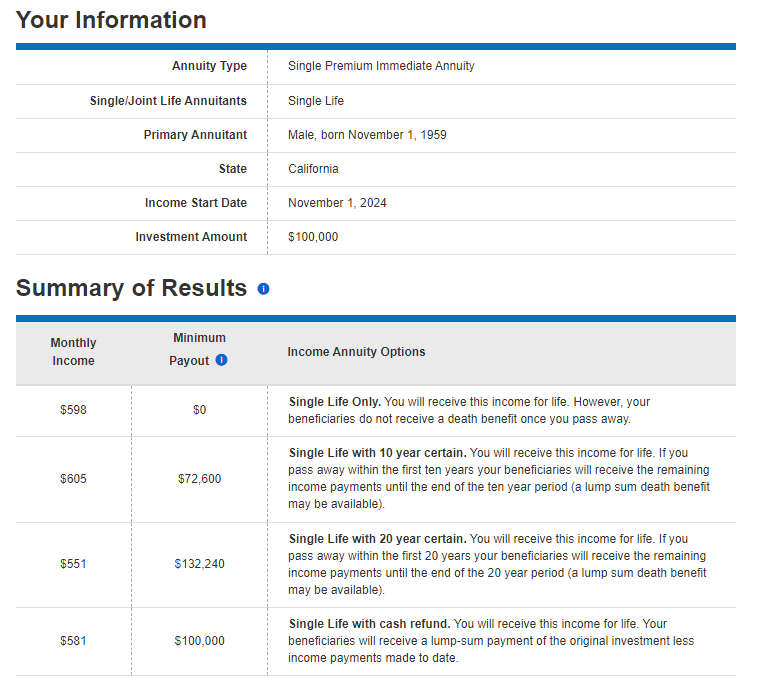

Here is an example 65-year-old male from California and what Schwab believes they could get for a quote (assuming they are of average health) if they put in $100,000 into a SPIA.

Credit: Charles Schwab

Calculator

Because Single Premium Immediate Annuities are insurance products, there is an underwriting process that involves a health screening; sometimes, that is just the agent asking a few questions, sometimes a visit from a doctor to do a check-up. It depends on the carrier and their requirements.

Once that information is submitted, most carriers are willing to give quotes. There are a lot of places to get quotes from, but I always recommend the Charles Schwab calculator, as it is one of the most intuitive to use and explains the riders well.

Suitability

This is a huge issue with annuities, as often the reason folks have heard negative things about it is that they were sold an annuity when it wasn’t suitable for them. Here are some of the major factors to consider when deciding how much of your portfolio to a Single Premium Immediate Annuity.

It must be less than 50% of your portfolio at most, ideally less than 30%. This is to preserve liquidity.

What do you need it for? Annuities are great for making sure you don’t outlive your money, since they pay for your entire life, regardless of how much you paid into the annuity. This is the primary reason folks want an annuity, to ensure a certain level of income in retirement. Other reasons may include tax deferment and a lack of contribution limits, the latter of which is not true in other tax-advantaged vehicles like 401Ks and IRAs.

Risks

So what do we need to worry about with Single Premium Immediate Annuities?

The first is liquidity. These are incredibly illiquid vehicles. They often come with a refund period in the beginning where you can go back on it, but once that has passed, there are usually high fees levied on the annuity’s value if the annuitant wants to go back on it. This is usual if the annuitant has been placed well, since they should still have ample liquidity for their needs and emergencies after the purchase of an SPIA. If this isn’t the case, you may have a case against that financial advisor for negligence.

The second major risk to address is that these vehicles can be complicated. While I have covered several of the most common riders, there are a near-infinite number of them from all the various insurance carriers that do business in your state. They are not as straightforward as most investments and this can be obfuscating to investors. Make sure you understand the terms of your annuity, what it pays out, when, and to who before you sign anything. What happens if you die in 5, 10, 20, or 30 years? These are very important questions to ask your advisor to clarify if or how an annuity may benefit you and your family. This is a product that should work for you, not the other way around.

Conclusion

Ultimately, Single Premium Immediate Annuities present as a great tool for many investors to add instant income to their portfolio at a high cost upfront, but ensures a certain level of income for life. These are powerful tools in a portfolio to reduce market risk, rate risk, and more, as they are not tied to any index typically and cannot lose principle. To figure out if a SPIA is right for your portfolio, you should speak to an advisor and discuss your total portfolio, as they only make sense in the complete financial picture. Securing lifetime income can be stress relieving, risk reducing, and provide peace of mind in monthly income above and beyond Social Security, pensions, or retirement accounts.

Thanks for reading.