Fidelity Contrafund Review — FCNTX

Introduction

I was introduced to Fidelity’s Contrafund (FCNTX) by my grandmother (shoutout to Nana!) when I first started investing. I asked her what she was invested in, and I was very confused when I saw her portfolio. What the heck is a Contrafund? She swore by it, had held it for twenty years, and would never divest if she didn’t have to.

The best way I’ve heard Contrafund described is in an interview with its long-time manager, Will Danoff. He said something to the effect of, “I take the S&P 500 and remove all the garbage.” The fund itself owns 378 stocks, including several private companies that I’ll expand on next.

Holdings

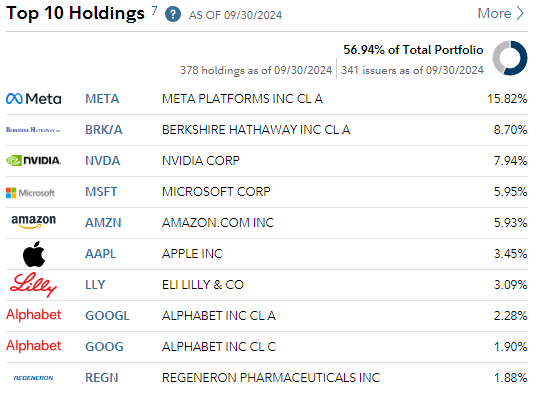

Like most large cap funds, FCNTX’s largest holdings are mega-cap tech companies, but the weighting is very interesting; their largest position is an almost 15% stake in META!

Credit: Fidelity Investments

That’s a lot of Facebook, but of all the mega-cap tech to call undervalued and not garbage, it’s Facebook. They are in the data game, and they are very good at it, make a lot of money from it, and are not being scrutinized for antitrust right now like Apple and Google are.

What’s different from other large caps is its ability to access private companies. There are some great ones held in here, which you can see with a service like Fintel.

Here's some big off-market names they hold: SpaceX, Fanatics, Bytedance, Starlink, Canva, Epic Games (Fortnite), and Stripe

Performance

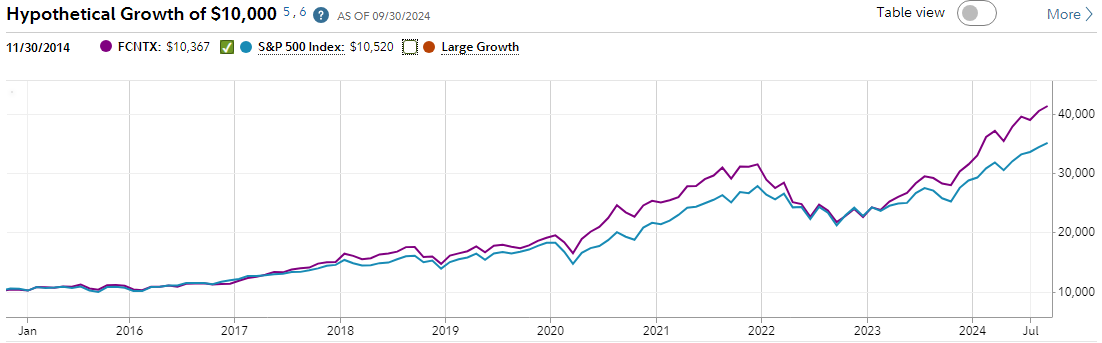

So how has it done? Well, one of the interesting things about Contrafund is that they have a great bragging point: if you take any rolling 10-yr period where Will Danoff was in charge, and it’s been 30 years, FCNTX beats the S&P over that timeframe. It’s wild.

Here is its performance against the S&P over the last ten years.

Credit: Fidelity Investments

High in Growth & Volatility

One of the other interesting things about Contrafund is its style breakdown; it is definitively a large-cap growth fund, but it holds many names in pursuit of value, such as META. This approach is sometimes called “GARP” or “growth at a reasonable price,” and there are other terms, but it essentially allows for value-driven valuations of growth companies within their own context.

What Danoff does with Contrafund is not GARP directly, but an opaque valuation method they use internally. While it is the only “black box” component in the fund, it’s a big one. You have to believe in the active management of the fund in order to invest in it.

Risks

The largest risk of holding this fund over the S&P 500 or a similar equity index is that it is often more volatile than the market, and can move opposite the market from time to time due to movements in some of its larger positions like META. Otherwise, traditional equity risk applies, as the fund holds US stocks, and so will be adversely affected by anything that hurts the broader market.

Because of their concentration in big names like META (15%), Berkshire Hathaway (8%), and NVIDIA (7%), there is also the risk that one of these stocks tanks the portfolio because of some idiosyncratic reason like a bad earnings call. Remember when META had that disastrous earnings result? This was back in 2022, when the first drop precipitated a downtrun lasting more than six months and getting close to 45% losses. Ouchie.

A similar event would hurt FCNTX far more than a traditional index fund.

Credit: Stephen Moore, Google

Conclusion

Ultimately, I am impressed with Contrafund for two major reasons:

Its outperformance against the S&P is long-established, with a lifetime return of 12.89% p.a. since inception in 1967.

It has access to private companies pre-IPO, which can provide excess returns that I normally don’t have access to.

This fund is for folks who want equity exposure, but want a manager’s touch. Danoff is a proven manager, based on his trackrecord. While I cannot vouch for the method underneath the hood, because it’s opaque to me as a retail investor, it seems to be based off of a mindset that there are great opportunities in growth investing so long as you pick the right ones and toss out the garbage.

Thanks for reading.