There’s Trouble Brewing in Beijing

Introduction

In June, I published an article on Seeking Alpha titled Why I'm Shorting Chinese Stocks, in which I advocated a pair-trade between the US and China, where I advocated going long the US markets and short the Chinese markets in the next few years for a variety of reasons. The article mostly covered the US-end of the trade. If you are interested in the ongoing Sino-American trade war and the impacts of American sanctions against China, please give that article a shot.

This article is a direct follow-up in which I will take a deep dive into Chinese political and business culture, their markets, and the implications that current trends in the country have on its outlook.

I am going to argue that China is seeing the beginning of the end for its current political and economic regimes and what major warning signs are currently flashing.

The Chinese Stock Market

For the last decade, Chinese stocks have been stagnant, mostly because of prolonged bear markets in 2015, 2019, and 2022. Going back to the iShares MSCI China ETF's (MCHI) inception, investors from launch are underwater 19.70%.

This has been a lost decade for the Chinese stock market, despite at one point being up over 80%. The question is, where will it go from here?

Data by YCharts

This is especially a concern for investors because China is the second largest economy in the world by nominal GDP. It boasts companies with near-exclusive access to its markets, which are expansive and highly regulated in some aspects (such as their new push to regulate AI usage and development), but sparsely regulated in others. This has made China a land of opportunity for many firms, despite the overall stagnation in prices seen above.

Contrarian and value-oriented investors are salivating at the lowered valuation and beaten-down nature of Chinese firms, but it is important for them to understand the major reasons why China underperformed.

In this article, I am going to argue that this underperformance will continue moving forward due to cultural, structural, and macroeconomic factors within China that is largely absent from the data in the chart above.

Providing Context

This article is going to be much longer than my normal pieces, because I believe that most of my readers will benefit from more thorough explanations and fewer assumptions of knowledge than I normally give when I write about US macroeconomics and geopolitics.

There are a few concepts that I believe are not only novel to western audiences, but key to understanding China and its markets. For this reason, I am going to spend the first few sections introducing political and cultural concepts so as to better frame the macroeconomic data when it comes up.

Table of Contents

This article is going to be split into several sections. I will make as much use of headings and subheadings as possible to differentiate ideas, as there is a lot of information to process and many readers will want to skip around or come back to concepts. Below is a quick overview of the primary section headers for convenience:

Introduction

Politics

Protest and Censorship Culture

The Financial Crisis

Chinese People are Divesting

The Real Estate Crisis

Is There a Solution to Either Crisis?

Ban Lai, the New Culture

Conclusion

Politics

The Chinese Communist Party

I don't have the time or space in my word count to even shallowly go into Chinese history, as it is really, really long. To demonstrate how long it is, Chinese civilization in some form pre-dates history. We can only go so far back before evidence for China becomes as nebulous as the evidence for most historic myths, i.e. oral tradition backing up secondary and no primary sources to speak of.

For our purposes today, modern China really starts at the end of the Chinese Civil War in 1949, with the rise of Chinese Communist Party, or from here on out, the CCP.

20th National Congress, 2022 (Xinhua)

The CCP is the ruling organ of China and is run by a unitary leader, the general secretary. It has many other parts, but the CCP has spent the last decade trying to consolidate power and wrestle it away from these other bodies. As recent as March of this year, the CCP has wrestled more powers away from both the National Peoples' Congress and local state authorities.

While the CCP's internal promotion system is supposed to promote meritocracy, China has suffered from chronic, systemic corruption for as long as the CCP has been in power. Bribes are considered common on the local level, and political purges of rivals is considered normal.

That is not to say that China was free of corruption before the CCP. I am just not going back that far in history for the purposes of this article.

A Party of Corruption

China ranks 65th in the world (tied with Cuba and Montenegro) in the corruption perceptions index done by Transparency.org. For context, the US ranks 24th. Generally, the government is opaque and secretive. They lie to public data collection agencies to improve their image. This means that any set of recent data taken on China may or may not be accurate. It is common for analysts to assume that most, if not all, data released by the government is staged.

To understand why such a large organization with almost a hundred million members and millions of insiders with access to the truth could conceal information so easily, we need to understand two things: the concept of vranyo, and the CCP's relationship with the law.

Institutionalized Lying or "Vranyo"

Very briefly, vranyo is a Russian word for a social phenomenon in which people accept lies that they know are lies and do not call out the liar in order to preserve social harmony or some kind of gain, usually to conceal corruption. It is best summarized in English as "institutionalized lying." It is part of the culture of many authoritarian regimes, as people under the regime learn that it is better for them to go along with the lies either for their own gain or to avoid the state punishing them. China suffers very heavily from this. I will reference this idea several times in this article as I discuss actions that the CCP has taken.

The CCP and the Law

The CCP is the ultimate political authority in the country. All people, including its own members, are accountable to it. Even the law is accountable to the CCP, as the CCP can choose who is or who is not to be held to the law depending on the context of the situation. This is a de jure ability of the CCP under current Chinese law.

In China, the relationship between the government, the law, and the people looks like this:

Chinese Relationship with Law (Ryan Chapman)

This is in contrast to most western systems, where our concept of the law is that it is inflexible and that no one is above it.

Typical Western Relationship with Law (Ryan Chapman)

No matter who is caught breaking the law, they can be taken to court and tried for criminal acts, even if it is an entire governmental body or jurisdiction.

In western governments, citizens are typically allowed to sue their governments and take them to court. That does not happen in China. Law, in Chinese political culture, is a flexible concept. This is part of why lying to the public en-masse is seen as normal and acceptable by party members with access to the truth. Culturally, the ends justifying the means is acceptable within the CCP.

Xi Jinping

Since 2012, the secretary general of the party and president of China has been Xi Jinping. He is the unilateral leader of the CCP, and therefore all of China. His political power primarily comes from the cadres of politicians and bureaucrats that align themselves with him, such as the New Zhijiang Army and the Tsinghua Clique.

Jinping is the son of Xi Zhongxun, who was a contemporary of Mao Zedong and held several important positions and offices throughout his career both in the Chinese Red Army (before, during, and after the civil war) and the Chinese civil service before being publicly declared an enemy of the revolution and imprisoned during a Maoist purge. He was released sixteen years later, after Mao passed, and the subsequent regime released many of Mao's prisoners.

Xi Jinping is part of a troubled political dynasty. His mother was forced to publicly denounce Zhongxun at a parade for his shame. Xi Jinping has always publicly held steadfast to the party line, and has been revered for his impartiality surrounding this affair with his father.

Xi Jinping (left) & Xi Zhongxun (right), 1979 (CGTN)

Growing Up a Princeling

The children of this generation of leaders are called "Princelings" or "Red Princes." Don't get it wrong, Xi Jinping is currently seventy-one and is certainly more like a king in China today than a prince.

Xi Jinping, March 2024 (Business Standard)

The affair with his father caused Xi the younger to be sent off to work on a farm in rural China for the decade that his father was imprisoned. It was part of a program designed to ensure the Red Princes were not spoiled by their access to power. He gained a significant perspective on the plight of subsistence farmers in China during this time, living around extreme, abject poverty that plagued China during the 1960s and 70s. Xi was also radicalized during his time spent living on these farms.

This is an important note here because Xi has significant control of Chinese markets, and he is not a capitalist at heart. While he seems to be in favor of reform and regulation over re-nationalizing all industries, Xi has been working toward tighter and tighter market regulations in the last few years, and has been punishing wayward oligarchs like Jack Ma and Bao Fan. Xi may be willing to allow significantly more pain to the markets if it means fulfilling ideological goals of his, something he has hinted to before.

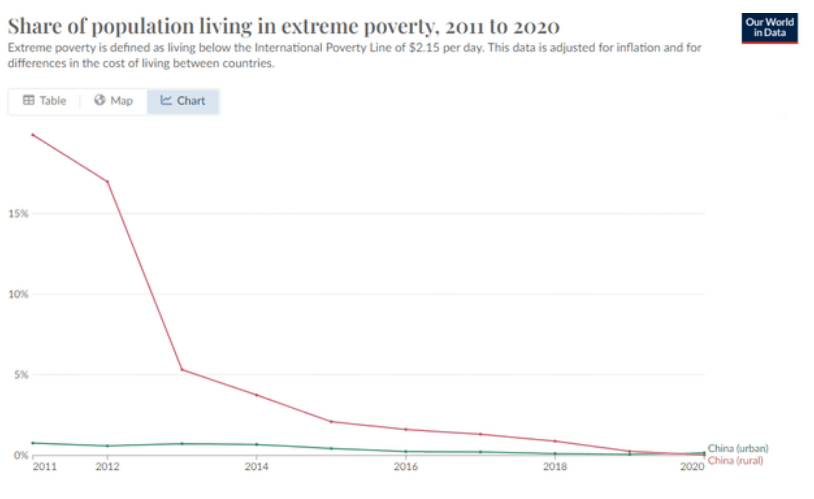

Xi Oversaw the End of Abject Poverty

Uncle Xi, as the media used to call him, gained much of his fame from the growth that China has made, and the prosperity it has seen, since his rule began.

He has taken many steps to lift the poorest people in China out of poverty, and has done a significant job of it, drastically reducing and near eliminating rural poverty since he took power in 2012.

(Our World in Data)

GDP-per-capita has doubled during his tenure, something Xi is very proud of, and rightfully so. The people in China are living better, becoming more productive.

Data by YCharts

It is to note that the Chinese stock market has shown absolutely no correlation to this statistic since the peak of the Chinese markets in 2021, but followed the trend fairly closely before then.

Catching Tigers and Flies

One of Xi's first major moves in office was an anti-corruption crackdown, where he vowed to catch the "tigers and flies," both high-level and low-level government officials. He has continued these crackdowns, having gone through several waves of political purges since then, and is currently purging generals in the armed forces.

Bo Xiali, Xi's main political rival, at his trial in 2013 (AP)

In total, Xi has purged upwards of 3 million officials belonging to all levels of government. This has decimated the bureaucratic power and prowess of the party and of regional governments. There are virtually no senior officials left from before Xi's generation, and the few that are left of his generation are part of his clique and have been loyal to him for the last thirty years.

His predecessor, Hu Jintao, was forcefully removed from the 20th National Congress before a vote for unknown reasons. The official state response was that he was feeling unwell.

Hu Jintao, Xi's predecessor, being escorted away, 2022 (Kevin Frayer)

This political climate having raged on for the last decade has led to a power vacuum below Xi, as there is currently no clear successor or plan for succession in place. Xi Jinping has "imprisoned and executed his way into being a cult of personality," as said by geopolitics analyst Peter Zeihan in a recent upload to his website.

Protest and Censorship Culture

Modern Chinese culture is very unique in that it is very much a product of the Internet Age like modern culture in the west, but in China, it is the product of a very heavily censored and curated internet. It has little outside influence, and since what does permeate the Chinese net is subject to extreme censorship by the CCP, the state has been mostly able to control online interactions among Chinese "netizens" (a term widely popular in China to describe people active on the internet).

Domestic Chinese internet connections are monitored by the government through a system officially called the "Golden Shield," and unofficially called the "Great Firewall." Without cybersecurity tools like VPNs, about a third of people have access to them, the government is able to track everything its people do online.

This means that almost all services Chinese people use are hosted in China and monitored by the Chinese government. If companies refuse to comply with these restrictions, such as Google, which exited the country in 2010, they cannot do business in China or access its billion-plus consumers.

Fun Fact: The Golden Shield system cost the Chinese government over $700M dollars and was actually built by American firm Cisco Systems, Inc. (CSCO).

Social media platforms are now required to show user locations and IP addresses to lessen online anonymity even among individuals and to discourage the use of these workaround tools when using Chinese social media. This makes it far more difficult for activists to hide from the government censors and still post or communicate online.

Despite this, a distinct Chinese protest culture has emerged separate from that of Hong Kong.

Protests are Becoming More Common

There has been a notable uptick in protests, which because of the lack of freedom of speech, often happen spontaneously and are broken up quickly.

Outside observer, China Dissent Monitor, noted a three-fold increase in labor-related protests from Sept-Dec of 2023 against the year prior. Of the last three thousand reported protests, about a third of them are spontaneous group demonstrations.

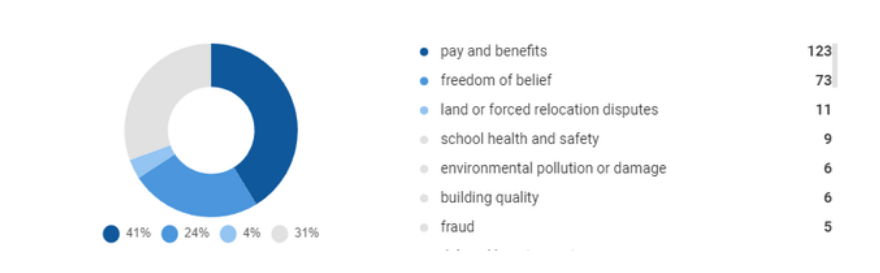

In 2024, there have been over a thousand demonstrations, with pay and benefits as the most common reason.

Reasons for protests in China in 2024 (China Dissent Monitor)

Protests are Becoming Smarter

The current Chinese populace has become very good at evading censorship to spread their message, even in physical protests. See, for example, in 2022 how protesters and activists used blank paper to protest lockdown restrictions. Because citizens are unable to criticize the CCP, they did not write anything on their papers. However, if you know why they are protesting, you don't need to read anything from their signs. This is a "dog whistle" tactic and is becoming widely popular in China among everyday people to avoid censors.

A4 Protests, 2022 (Fortune)

The Financial Crisis

We are finally ready to discuss the financial situation in China, starting with its people, now that the frontloading of politics and culture is done. This is the primary reason for the protests, so let's start here.

The Income Gap is Widening

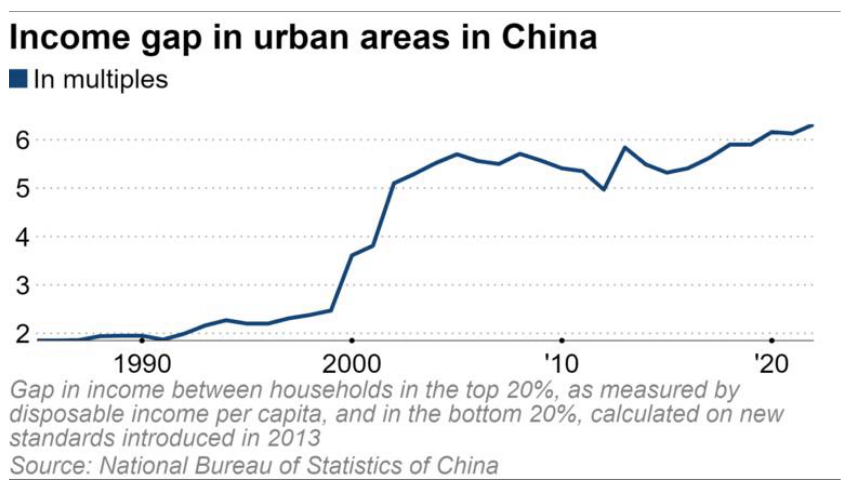

Many of the previously mentioned protests are freedom related and politically motivated, like the example above, but as mentioned earlier, a plurality of protests are regarding economic conditions. This partially stems from an income gap in urban areas, which has only gotten worse since Xi took over in 2012.

Income Gap in China (National Bureau of Statistics of China)

Dealing with this was fairly straightforward for the CCP. Just make sure nobody sees it. I am being facetious by phrasing it this way, but their solution really was to sweep it under the rug.

A little over a year ago, the government began to censor online content that displayed someone's overly lavish or "hedonistic" (to use the CCP's term) lifestyle. They also began to censor content showing abject poverty and destitution in China, as well as any videos showing the corruption of officials or the manufacturing of counterfeit goods (this even includes counterfeit food, not just watches and handbags).

This is another instance of vranyo, where we know that this law is not actually fixing the fact that some people are extremely rich while others live in poverty, but by concealing it, we are expected to move on and forget those things ever existed. That last part is the reason vranyo is useful for regimes like the CCP; it is a tool to promote social harmony. It is also a tool that the Chinese people are tired of being abused with, but it has taken decades to get to this point.

I bring this up at the top of the section about the financial crisis because it's important for us to see how the government is dealing with these kinds of problems. It is a display of governmental ineptitude that is hard to explain without a concrete example.

Now we can get into the mud.

Consumption Was Supposed to Save the Economy

Raising Chinese domestic consumption was one of the prominent goals of the CCP back in 2004, announced at the Central Economic Work Conference, and remains so today. Under the "common prosperity" doctrine that Xi has tried to implement, Chinese households are encouraged to spend as much as possible and save little, with the expectation that buying assets like stocks and property would fuel domestic growth and make everyone richer.

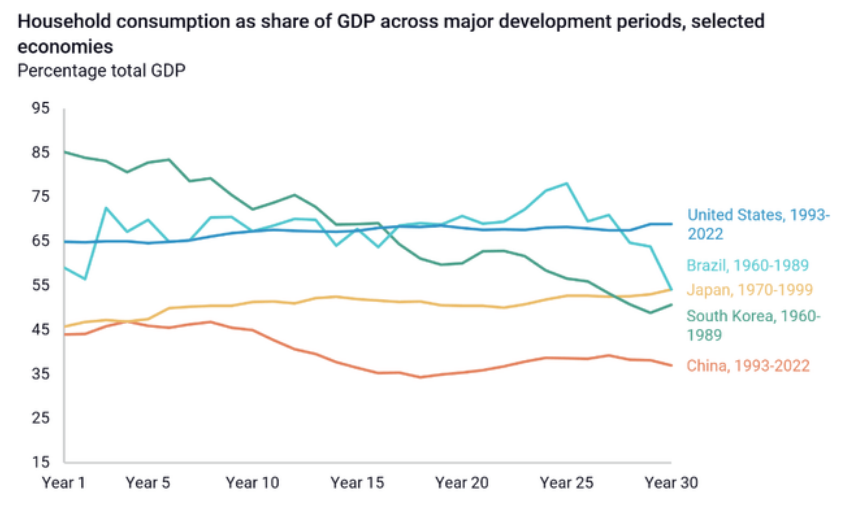

However, we've seen a reduction in household consumption as a percentage of GDP since the regime change in 2012, a reversal of much of the progress China had made in the decade prior.

OECD vs China GDP (IMF)

Compared to other peers in emergent and developed markets during their periods of tremendous growth, we've seen a different trend. If they experience a decline in consumption, it is usually toward the end of their development.

An exception to this is South Korea in the chart below, which started 1960 at a period of incredibly low domestic and foreign investment due to the devastation of the Korean War. They survived this "death spiral" only through tremendous amounts of economic stimulus and investment, both internally and externally.

Selected Timeframes of Growth (World Bank)

Investment is what carried much of China's monstrous growth, but developed economies cannot infinitely invest in themselves. They must have real growth driven by consumption. What is stopping the Chinese people from consuming?

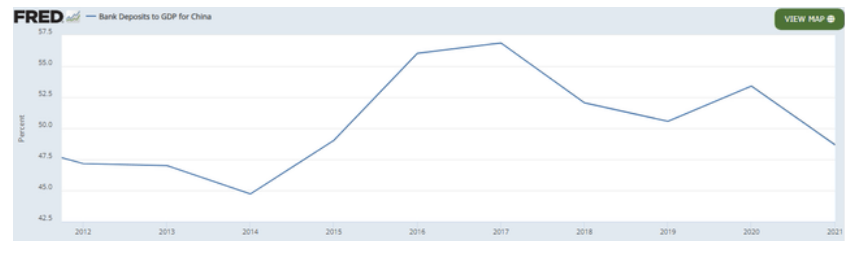

People Are Running Out of Money

Bank deposits-to-GDP was falling drastically from pre-pandemic levels during China's lockdowns. The economic conditions have gotten bad enough that most personal finance statistics published by the government were pulled and have not been published since 2021, so my data on this only goes that far.

China's Bank Deposit to GDP Ratio (FRED)

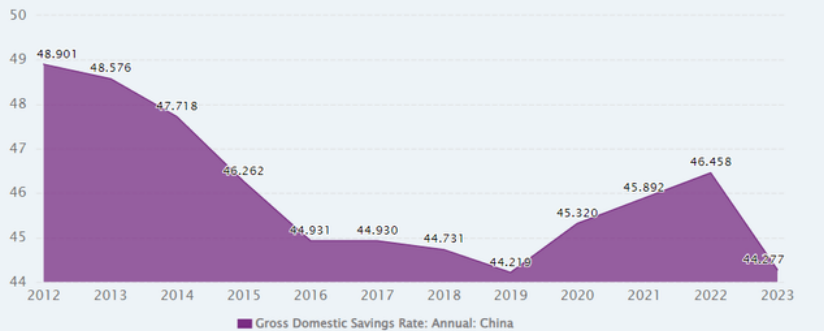

We've seen a consistent downtrend of the domestic savings rate as well, with a very steep decline last year.

Chinese Domestic Savings Rate (CEIC Data)

This would not be a problem if it meant that people were using that money to consume instead, which would fuel businesses in the economy. We've seen the opposite, however.

Disinflation and Deflation

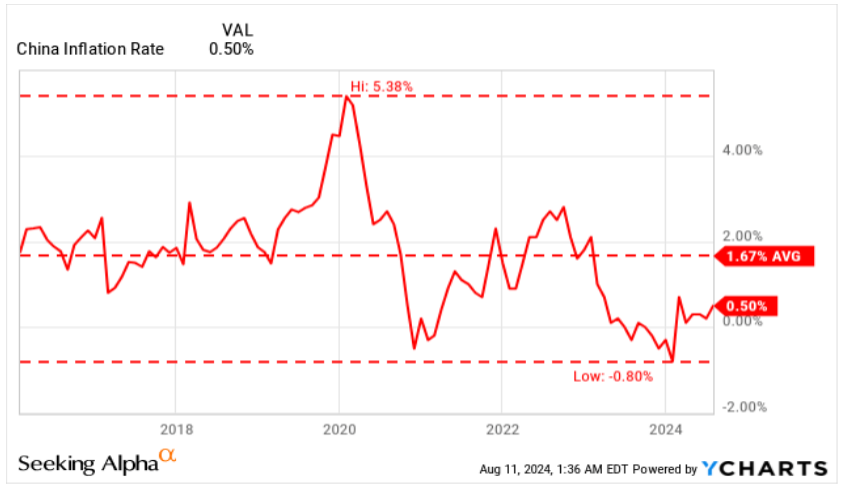

The Chinese inflation rate not only fall much faster than in western countries following the pandemic-related global inflationary episode, they actually experienced some level of deflation, with the bottom of the trough being at (0.8)% earlier this year.

During negative inflation rates (or positive deflation rates), prices are falling. This is typically due to a lack of consumption of products, leading to surplus, and thus merchants needing to lower prices to entice consumers.

Data by YCharts

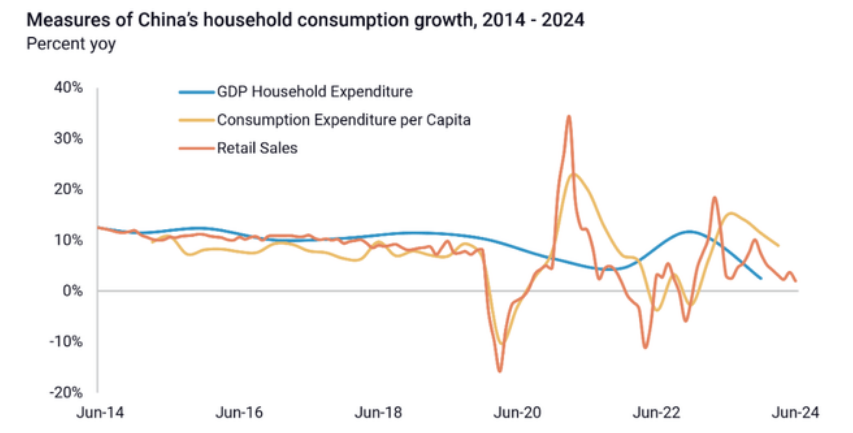

You can see an almost inverse of this chart when you look at consumption expenditures per capita, as consumers changed their buying habits in real-time with inflationary changes.

Household Consumption & Retail Sales (National Bureau of Statistics of China)

In response to these falling retail sales, some domestic retailers are shifting to entirely online business models. Physical retails sales have fallen dramatically since the pandemic, and online sales have become far more common. Gome Retail Holdings (HK:0493), which operates as a retail conglomerate across China, spent most of last year shutting down its retail locations. They closed 90% of them. Sales revenue is likewise down 90%, Gome announced in September last year.

Pay Cuts or "Wage Deflation"

Some of the protests are a result of civil workers' pay being made in arrears, and some having to go months without proper paychecks, as local governments have become insolvent in many jurisdictions.

To solve this issue, the government cut wages. The Guangdong province cut their civil servants' wages by 25%!

China's second largest bank by assets, the China Construction Bank (HK:0939), has slashed its wages by 10%, and more for managers. The Bank of China (HK:3988) has also been reducing manager salaries to bridge employee-employer income gaps.

Some financiers are even being asked to return checks already issued to them and take retroactive pay cuts.

Some workers have to settle for lower paying jobs in order to find work, since unemployment is so high that employers can offer lower wages and still find candidates.

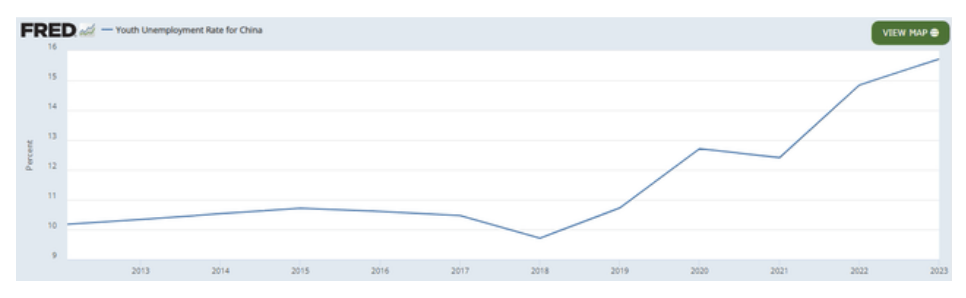

Unemployment is a Major Issue

It is the worst with young people. It has become so bad that the government stopped publishing data on this statistic entirely in August 2023.

Youth Unemployment in China (FRED)

The Economist measured that the youth unemployment rate was at 25% back in April of this year, with nearly 40% of those people being college graduates.

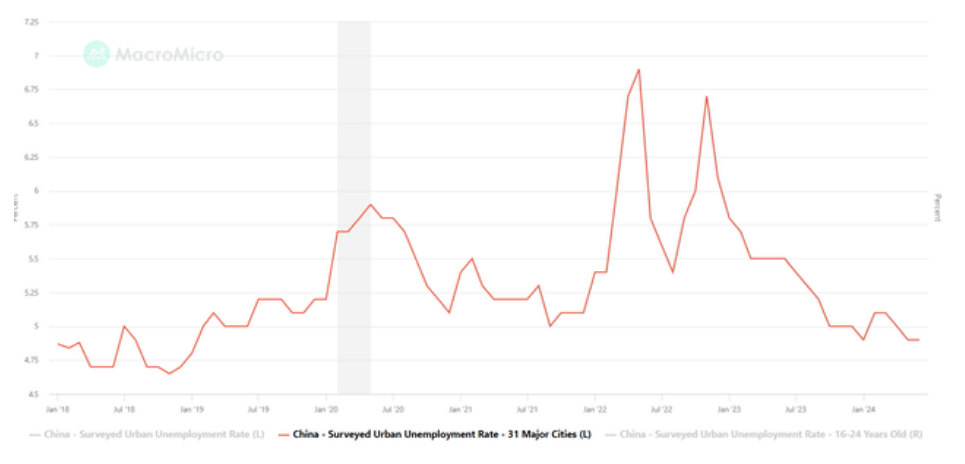

When you look at the general urban unemployment rate, however, you see something interesting: it's been pretty steady at 5% since January.

Chinese Urban Unemployment Rate (National Bureau of Statistics of China)

This is not an accurate statistic, unfortunately. It is another instance of vryano.

The National Bureau of Statistics quietly changed the requirements to be considered "employed" earlier this year. A citizen does not qualify as "unemployed" so long as they worked for at least one hour a week, counting any work they performed, including flexibly employed people through delivery apps, migrant workers who travel to cities to do manual labor (nearly 300 million people), and independent business owners (nearly 150M).

In another effort to doctor the data for younger people, earlier this month, the government added "live streamer" to their list of official jobs. This means that if you go live on a social media platform, for one hour per week, you are not unemployed and do not count in this statistic.

Chinese People Are Divesting

The Chinese stock market has devastated many people in China who believed it was a path to wealth, believing in the Chinese Dream idea that was sold to them by the CCP. Middle class investors are now primarily investing in real assets such as gold or property. Young people, who have little to no access to capital in China's current employment state, are not picking up the slack and buying stock sold by the older generation.

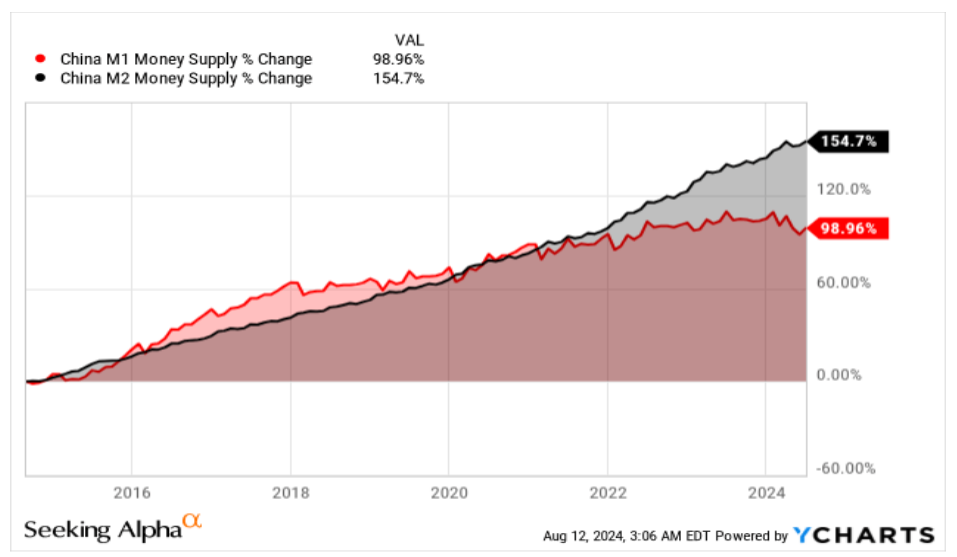

One of the ways we can visualize capital flows like this is with the money supply.

For quick reference back to Economics class, M1 is liquid cash, e.g. savings accounts, and M2 is M1 plus illiquid cash, e.g. money market funds, timed deposits, etc.

If money is moving from M2 to M1, shown below when the M1 line (red) is accelerating faster than M2 (black), like from 2016 - 2020, that means people are making cash readily available to them. This is considered a sign of economic strength as it means that they are likely going to use that cash to invest or consume instead of save.

Data by YCharts

Since 2022, we've seen a stagnation of M1 money, meaning that peoples' access to liquid cash has not changed significantly in the last two years despite the large increase in the larger M2 money supply. Since 2021, M2 has accelerated and M1 has decelerated, reversing previous trends. This means that investors are pulling money out of non-cash assets and putting them into timed and illiquid deposits, not keeping it as cash. This means that they are not re-balancing investments or re-deploying capital to new investments.

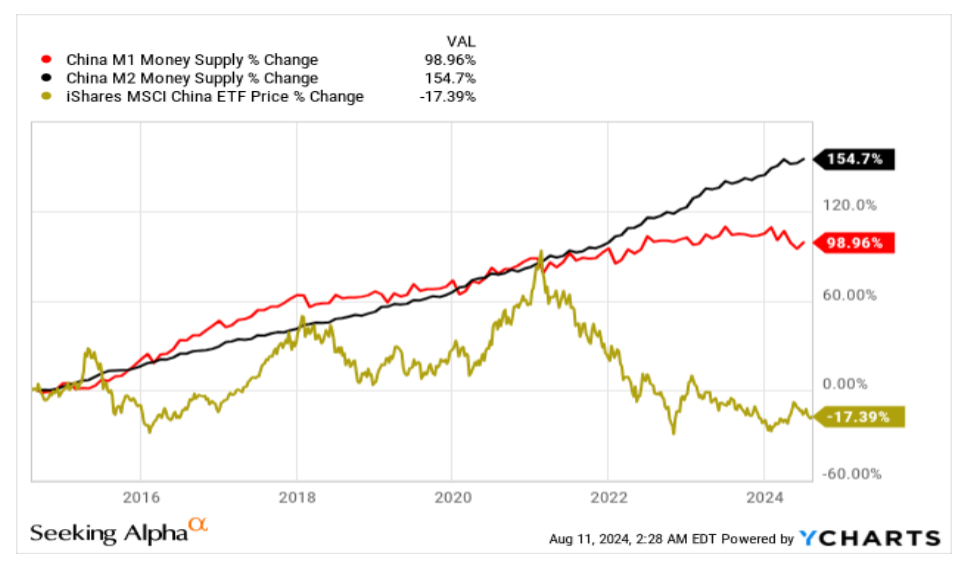

Unsurprisingly, this trend started exactly when the Chinese markets began to crash, something they have yet to recover from. Here is the same ten-year chart but with the Chinese market ETF superimposed. You can see that the peak of the markets was exactly when the two figures flipped position in 2021. As the markets fell, locked deposits increased and liquid cash stagnated.

Data by YCharts

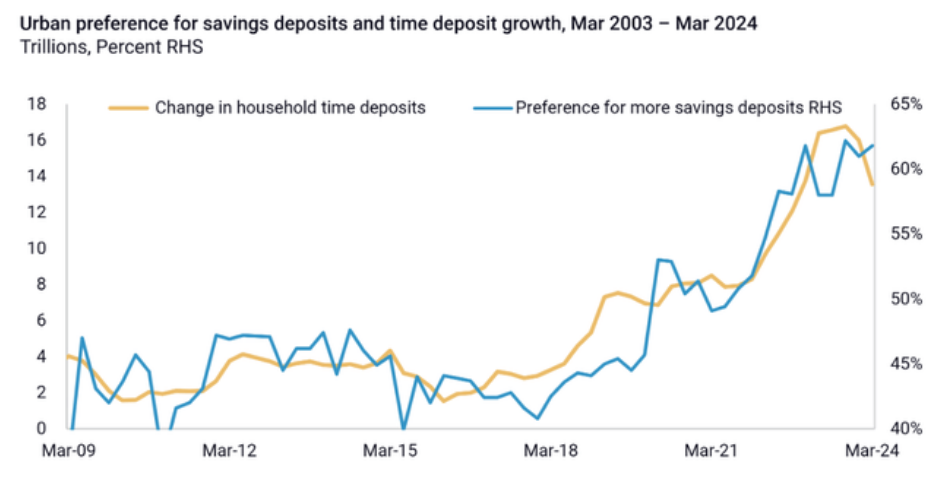

When polled, households in China have shown an increasing preference for timed deposits since 2018, starting far before the current market collapse in the 2018-2020 Chinese bear market. The market fall only accelerated this trend.

Timed Deposit Preferences (Bank of China)

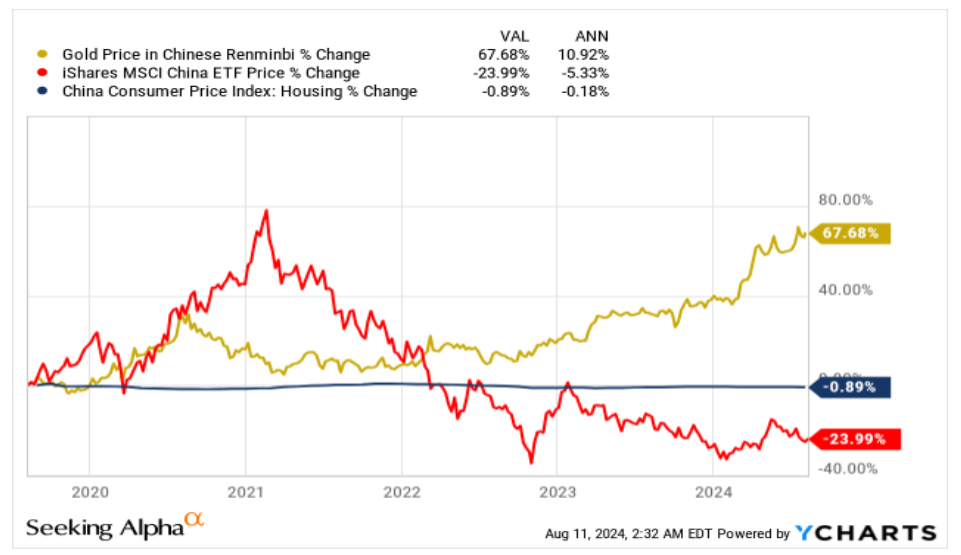

They Are Using the Money to Buy Gold

The Chinese have been hoarding gold recently, and has been called out by analysts as one of the catalysts for gold's new all-time high prices.

Mass gold hoarding is a bad sign because it means that people have lost faith in Chinese Yuan, and believe gold will hold better value than it. Available cash from M1 may also be exiting entirely to be put into hard assets like metals.

To the credit of Chinese gold bugs, in the last five years, they were much better off owning gold than stocks or real estate.

Data by YCharts

Another major factor is that savings accounts in China have not improved. Unlike the west where savings accounts are currently paying very well due to high central bank rates, the Chinese deposit rate has remained unchanged at 1.5% for a very long time. This means that people are not seeing cash as a better earning opportunity, which is typically the reason for M2 accelerating and M1 decelerating.

Chinese investors are divesting from their economy and markets.

The Real Estate Crisis

Mass Development Projects in Beijing (Bloomberg)

The CCP has traditionally had local governments finance much of their revenue through land sales, which was wildly successful until recently. Provincial governments raise most of their revenue through urban land-use rights ("LURs"), the revenue for which is based on how profitable these developments might be to build.

Overleveraged developer Evergrande began an avalanche of defaults and financing issues within Chinese real estate back in January of this year.

Developers have had to halt construction on some of these affected projects, and are no longer interested in developing many of them now that doing so will only result in more losses.

Eventually, someone has to buy these properties, live in them, and make them productive, or else the market collapses entirely. It is unclear as of now if the Chinese government will fix this crisis with western-style bailouts or something else entirely.

Until they find a solution, more problems are emerging. Outstanding mortgage loans shrunk in size for the first time in over a decade, right before the crisis began.

Outstanding Mortgages (Bank of China)

This shift in consumer demand is largely due to the price collapse that started as the downtrend began, and has made investors unwilling to buy more properties.

Real Property Prices in China (FRED)

Much of China's real estate is held by individuals, and the financial crisis discussed in the earlier section has rendered many private landlords unable to or unwilling to continue financing themselves deeper. Without the productive, consumptive population to fill all of these housing projects, China still has over twenty of its infamous "ghost cities," developments built with no demand in place that go widely unused.

Is There a Solution to Either Crisis?

This brings us back to Xi Jinping, who is not interested in providing stimulus via deficit spending and welfare, like how the west has handled these kinds of crises in the past. In a speech he gave in 2022 regarding the issue of helping the population with social welfare programs, Xi said:

To promote common prosperity, we cannot engage in ‘welfarism.’ In the past, high welfare in some populist Latin American countries fostered a group of ‘lazy people’ who got something for nothing. As a result, their national finances were overwhelmed, and these countries fell into the ‘middle-income trap’ for a long time. Once welfare benefits go up, they cannot come down. It is unsustainable to engage in ‘welfarism’ that exceeds our capabilities. It will inevitably bring about serious economic and political problems.

Xi is not interested in helping the population through governmental spending, which means that any solution the CCP does offer will likely come at the cost of the Chinese people's well being. We are already starting to see this with the 25%+ youth unemployment rate mentioned earlier.

I hope that, by now, the CCP's answer to this problem is clear to you: pretend it doesn't exist and do everything they can to hide it from the public and delay any consequences as long as possible.

Jiucai or "Harvesting Leeks"

This is a phrase from Chinese that refers to being squeezed by the government for money. Jiucai is a systemic, corrupt practice in China where local governments create extortive fines for made-up laws to cover revenue shortfalls.

Outrageous fines, like this one aimed at a restaurant that served cucumber improperly, are illustrations of this budget-placating practice at play. Another locality has been handing out fines for not keeping your house in order. This locality has been shortchanging its zoo, forcing them to underfeed the animals.

Endeavors like these to raise funds are becoming more and more common in China and showcase how deep local governments' income shortfalls are.

Bai Lan, the New Culture

There are a ton of popular internet terms that have sprung up as netizens discuss the issues I've brought up here. Remember that China has a deeply ingrained culture of censorship, so it is not easy to proliferate these ideas. The ones that do make it out to western audiences are viral.

The one that captured my attention the most was "bai lan," or "letting it rot." This phrase calls on a sports reference, where basketball teams will intentionally lose a game in order to get a better draft pick later.

The idea has become more nuanced as it has gained traction and also refers to "embracing the end," or accepting that things are over. This idea has led many young people to stop their search for work, or attempts at working. This cultural shift is a major factor in youth unemployment.

This attitude has been likened to the end of the Soviet Union, where during the mid-to-late 1980s, Soviet citizens who saw the writing on the wall of the stopped working hard and emotionally investing themselves in their lives, instead choosing the to do the bare minimum in all aspects of their lives.

To actively accept a deteriorating situation is difficult and required a very steep level of defeatism.

This defeatist culture is one that has been brought about by the CCP's opaque and authoritarian nature. The population knows they are powerless to the government's whims. The young people, who are closest to the CCP's censors via their internet usage, know it the most.

So, why not just let it rot?

Conclusion

The Chinese markets are in a bind that they have created for themselves. At risk of being obtuse, it is very much like a Chinese finger trap toy. The CCP has stuck its fingers too deep and now can't pull them out. The CCP, instead of searching for solutions that require less force and more nuance, they are trying to rip their fingers free as hard as they can. What's unclear is if the trap will hold or snap.

This article presented several major topics of discussion that in aggregate, and in context together, paint a grim picture of the Chinese economy and its markets. There are deep, systematic problems in the country that are unlikely to be fixed anytime soon. So long as that is the case, I consider China and its markets un-investible. Avoid at all costs.

I am short the Chinese markets and intend to keep this position for some time, potentially years, as the CCP unravels and the issues presented in this article come to a head. This may only be the beginning of what issues are to come.

Thanks for reading.